Most capital investment projects begin with a large negative cash flow (the up-front investment) followed by a sequence of positive cash flows, and, therefore, have a unique IRR. When all negative cash flows occur earlier in the sequence than all positive cash flows, or when a project's sequence of cash flows contains only one negative cash flow, IRR returns a unique value. You can think of it as a special case of NPV, where the rate of return that is calculated is the interest rate corresponding to a 0 (zero) net present value. Where n is the number of cash flows, and i is the interest or discount rate.

FREE CASH FLOW TEMPLATE SERIES

NPV calculates that present value for each of the series of cash flows and adds them together to get the net present value. Because of the time value of money, receiving a dollar today is worth more than receiving a dollar tomorrow. NPV returns the net value of the cash flows - represented in today's dollars. Both NPV and IRR are based on a series of future payments (negative cash flow), income (positive cash flow), losses (negative cash flow), or "no-gainers" (zero cash flow). Both NPV and IRR are referred to as discounted cash flow methods because they factor the time value of money into your capital investment project evaluation. There are two financial methods that you can use to help you answer all of these questions: net present value (NPV) and internal rate of return (IRR). In other words, when cash goes out or comes in is just as important as how much cash goes out or comes in.

You can invest this money at a compounded interest rate, which means that your money can make you more money - and then some. My papa once told me, "Son, it's better to get your money as soon as possible and hold on to it as long as possible." Later in life, I learned why. But to get there, you must incorporate the time value of money into your analysis. In the end, what you really need are bottom-line numbers that you can use to compare project choices. What impact will a large initial investment have, and how much is too much? What are the negative and positive cash flows for this project?

Now take a closer look at each of those projects, and ask: Should I invest even more in an ongoing project, or is it time to cut my losses? Is the money better invested in another project? Is a new long-term project going to be profitable? When? If you want to take your money out of the till, make it working capital, and invest it in the projects that make up your business, you need to ask some questions about those projects: Asking questions about capital investment projects Microsoft Excel can help you compare options and make the right choices, so that you can rest easy both day and night. To grow your business, you need to make key decisions about where to invest your money over the long term.

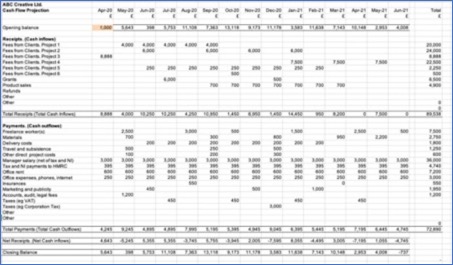

Net cash flow is the difference between your positive cash flow and your negative cash flow, and answers that most fundamental of business questions: How much money is left in the till? Positive cash flow is the measure of cash coming in (sales, earned interest, stock issues, and so on), whereas negative cash flow is the measure of cash going out (purchases, wages, taxes, and so on). Take a look at your cash flow, or what goes into and what goes out of your business. Relax and go with the flow.Ĭash, that is. Have you been losing sleep figuring out the best way to maximize profitability and minimize risk on your business investments? Stop tossing and turning.

0 kommentar(er)

0 kommentar(er)